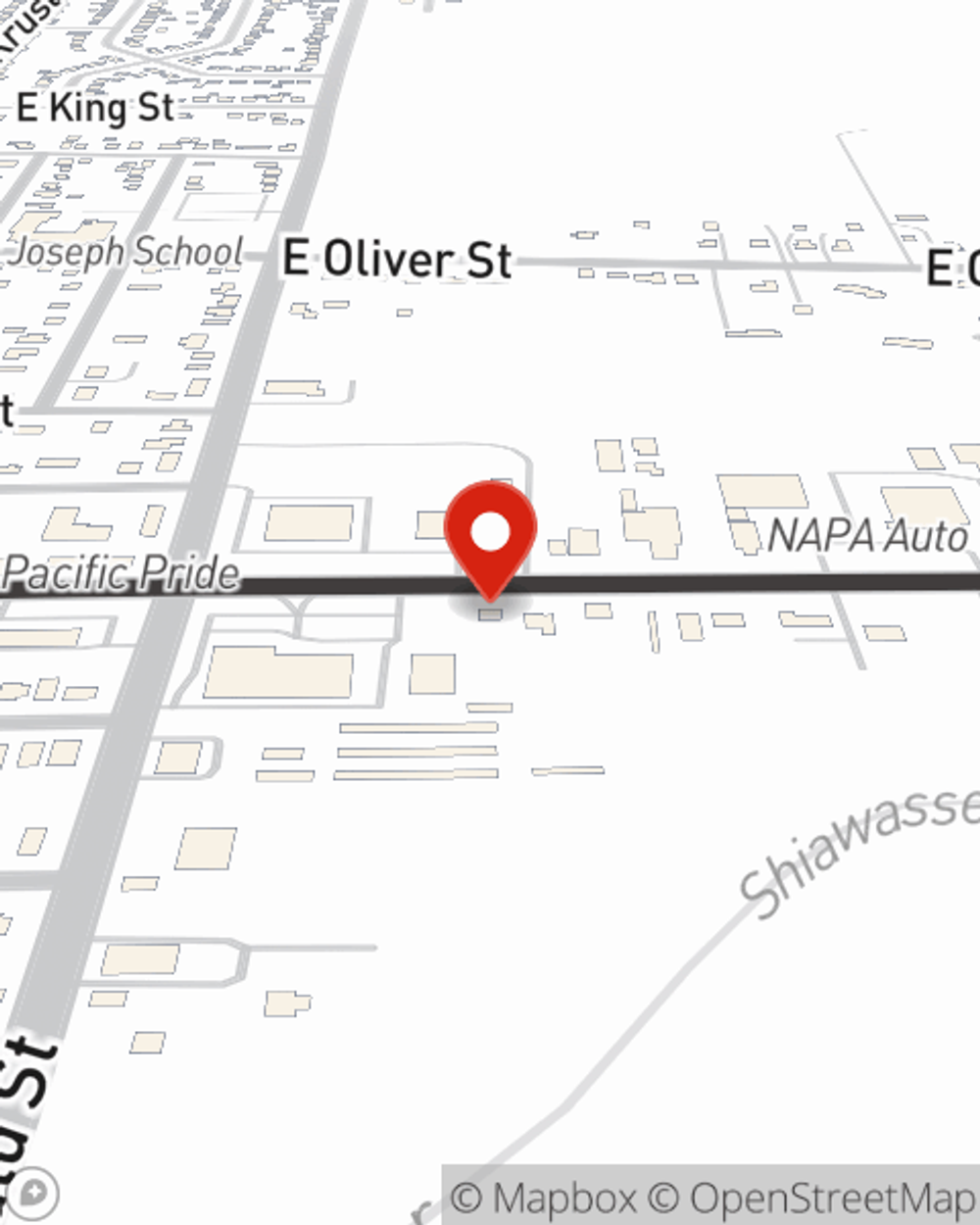

Business Insurance in and around Owosso

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and extra liability coverage, you can rest assured that your small business is properly protected.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a home cleaning service, a tailoring service, or a book store, having the right coverage for you is important. As a business owner, as well, State Farm agent Matt Grubb understands and is happy to help with customizing your policy options to fit your needs.

Call Matt Grubb today, and let's get down to business.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Matt Grubb

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.